To find out more from the company withholding conformity, discover Irs.gov/WHC. If, once you found an Internal revenue service see or amendment see, the personnel provides you with an alternative accomplished Function W-cuatro you to definitely results in a lot more withholding than just manage effects within the find or amendment notice, you ought to withhold taxation according to the the fresh Form W-cuatro. Regular personnel and you may group maybe not currently performing services. In some cases, in the event the a critical underwithholding problem is discover to thrive for an excellent type of personnel, the newest Internal revenue service get issue a lock-inside page for the workplace indicating the fresh worker’s enabled submitting condition and delivering withholding recommendations to the certain employee.

Enthusiasts may also partners restricted no-put bonuses which have social media ways or spouse promotions. Some says often see Fanatics roll-out test advertisements with no-deposit advantages, such as $20 inside added bonus wagers for only carrying out a free account. If you are Fanatics cannot currently give a zero-deposit incentive as an element of the national launch method, which could transform based on local campaigns.

Condemned documentary

Red Co. stated taxation for the its 2024 Form 943, line 13, away from $48,000. Flower Co. is a monthly plan depositor to own 2025 because the its taxation responsibility on the 4 household in lookback several months (third one-fourth 2023 due to second one-fourth 2024) wasn’t more than $50,100000. Flower Co. said Setting 941 fees the following. When you have more 1 shell out date throughout the an excellent semiweekly several months as well as the shell out dates belong some other go back symptoms, you’ll want to make separate deposits for the separate liabilities. When you yourself have a cover day to the Wednesday, Sep 29, 2026 (third one-fourth), plus one shell out date for the Monday, October 2, 2026 (last one-fourth), two separate dumps would be required while the pay times slide inside same semiweekly several months. When you have more than step one spend go out while in the a great semiweekly months plus the spend schedules belong various other diary household, you’ll want to make independent deposits to your separate debts.

- Cash wages were monitors, money purchases, and you can any money or dollars.

- Including, should your total tax in reality withheld are incorrectly stated for the Setting 941, Form 943, otherwise Setting 944 due to a statistical or transposition error, this will be an administrative error.

- Generally, the new FMV of such repayments at the time they’lso are offered is subject to government tax withholding and you can public shelter, Medicare, and FUTA taxation.

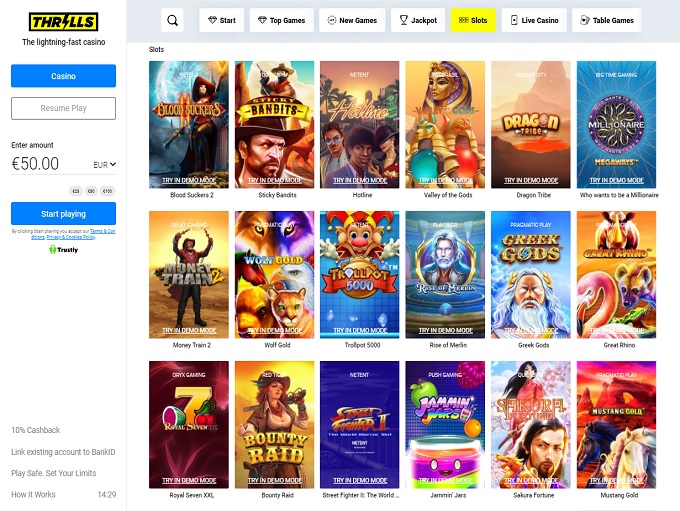

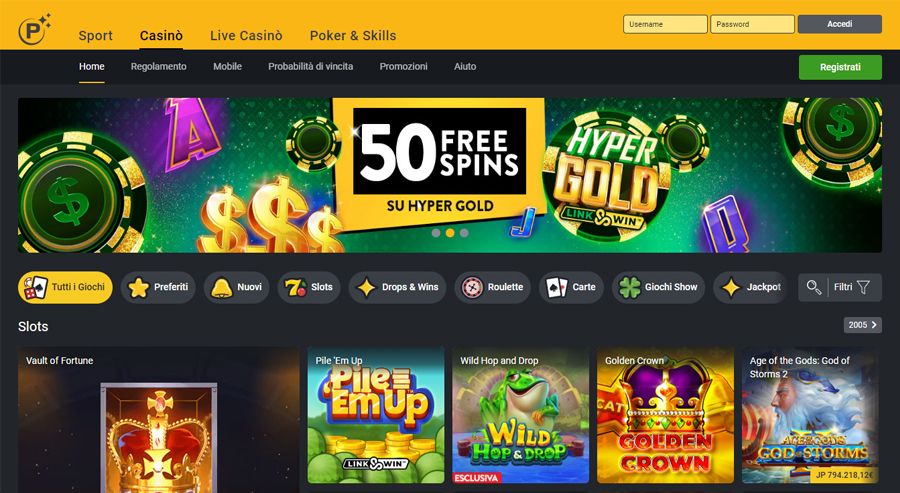

- Greatest web based casinos render a variety of systems to help you enjoy sensibly.

Yet not, a good statewide court getaway doesn’t decelerate the fresh due date out of government taxation deposits. Come across area 14 to have details about placing FUTA income tax. You can purchase variations, instructions, and you may courses shorter on the internet. For standard taxation suggestions relevant to agricultural companies, go to Internal revenue service.gov/AgricultureTaxCenter. Separate places are required to possess payroll (Form 941, Form 943, or Function 944) and you can nonpayroll (Mode 945) withholding.

Tax withholding is generally figured the same way for full-date experts otherwise it could be thought by the region-seasons a job method told me inside area six of Pub. Which exclusion is available as long as both staff and the company try members of the new sect. The united states have personal defense arrangements, known as totalization arrangements, with lots of regions you to eliminate twin societal shelter visibility and you will tax. To learn more, for instance the concept of an excellent “film venture boss” and you may a good “film venture staff,” find section 3512.

Seemed Game

Is they in the box hands down the personnel’s Function W-dos (container 7 out of Setting 499R-2/W-2PR), however, don’t amount it as public protection and you can Medicare earnings and you may don’t were it inside the packages step 3 and you can 5 (boxes 20 and 22 of Setting 499R-2/W-2PR). That it again increases the level of the other taxation that you need to pay. Medicare income tax flow from on the all the wages you have to pay Julian in the twelve months. For more information on what wages is actually subject to Medicare tax, come across point 15.

Make use of the following around three screening to determine if or not you need to pay https://happy-gambler.com/football/ FUTA income tax. Services made in order to a federally recognized Indian tribal government (otherwise people subdivision, subsidiary, or company entirely belonging to including a keen Indian tribe) are excused away from FUTA taxation, subject to the brand new tribe’s conformity that have state law. FUTA taxation doesn’t connect with employers in the American Samoa, Guam, and also the CNMI, although it does connect with businesses in the USVI and you will Puerto Rico.

To own 2026, Gavrielle paid Dan $step one,000 inside the year. Julian Gold, have been employed by Adam and you may obtained $dos,000 inside earnings before day out of get, went on to function for you. For more information on A lot more Medicare Tax, see Internal revenue service.gov/ADMTfaqs. There isn’t any employer share out of Additional Medicare Tax. Additional Medicare Tax is just imposed on the staff.

How can i Allege Enthusiasts Promos and you will Codes?

Of numerous casinos as well as apply a few-factor verification or any other security features to avoid unauthorized usage of your bank account. They use SSL encoding to guard your own and you can monetary suggestions while in the transactions. Knowing the terminology assurances you may make by far the most of the incentives and avoid people shocks. Specific casinos offer tiered support plans, that have large account unlocking a lot more advantages such as reduced distributions and you will individualized also offers. Earn things for each choice and you can get him or her for bonuses, dollars, or other benefits.

- The new employer have entry to EFTPS to ensure federal income tax dumps were made on the the part.

- Big Four are a good 5-reel slot having fifty paylines.

- The feedback common is actually our very own, per based on the genuine and you will objective analysis of the casinos i review.

- Come across casinos that have self-confident customers recommendations and you will a track record to possess advanced support.

- You can also use this count to have help with unsolved tax issues.

DraftKings often launch the newest $step one,one hundred thousand added bonus inside $step 1 increments every time you wager $twenty-five for the market which have -three hundred opportunity otherwise expanded. The good news is, the newest DraftKings bonus framework makes you features multiple shifts during the a profitable go after-up. Since the incentive comes in several portions, I recommend using this type of while the the opportunity to talk about various other gaming locations. „The fresh DraftKings promo is a great starting point for the brand new sporting events gamblers making an application for its ft damp instead a hefty put.” „The ability to score $three hundred within the added bonus wagers, from a moderate $5, gift ideas a large well worth in the current sports betting ecosystem.”

Declaration both workplace display and you may personnel show from public security and you will Medicare taxes for unwell shell out on the Mode 941, traces 5a and you will 5c (or Setting 943, traces dos and you may 4; or Mode 944, outlines 4a and you can 4c). So it rounding occurs when your profile the degree of societal defense and you will Medicare taxation to be withheld and you will deposited out of for each and every personnel’s earnings. An excellent payer out of nonpayroll repayments you to withheld government tax or content withholding have to file just one Mode 945 annually. Basically, using a 3rd-people payer, such as a good PSP otherwise reporting representative, doesn’t lightens an employer of your responsibility to ensure taxation statements are filed and all sorts of taxes try paid back otherwise deposited precisely and you will on time. If you keep back or have to withhold government income tax (as well as backup withholding) away from nonpayroll repayments, you ought to document Setting 945. For those who’re a realtor having a prescription Form 2678, the fresh deposit regulations apply at you according to the full employment taxation collected on your part for your own personel staff as well as on part of all the companies to have who you’re signed up to act.

In case your personnel really wants to set another Setting W-cuatro to the impact you to definitely causes smaller withholding than simply required, the newest employee need to contact the new Internal revenue service. If you discover a notice for a worker which isn’t currently doing features for your requirements, you’lso are nonetheless needed to furnish the brand new personnel backup to the staff and withhold in line with the see if any of your following the pertain. The newest decelerate between the bill of the see and the go out to start the newest withholding based on the notice permits the fresh employee time for you contact the brand new Irs.

Personal shelter and Medicare taxation create apply to costs designed to a father to possess domestic functions if the all of the after the use. Residential features at the mercy of social protection and you will Medicare taxes. Costs for the services out of a child less than ages 18 which works best for their mother or father in the a trade otherwise organization aren’t at the mercy of public defense and you can Medicare taxation if your exchange or organization is a sole proprietorship or a collaboration where per spouse is actually a daddy of one’s son.

Absolwentka Wydziału Stomatologii Akademii Medycznej w Lublinie. Zajmuje się stomatologią zachowawczą z endodoncją, stomatologią estetyczną, protetyką oraz periodontologią. W tych dziedzinach na bieżąco podnosi swoje kwalifikacje, uczestnicząc w licznych kursach, szkoleniach oraz konferencjach naukowych. Doktor posiada duże doświadczenie w pracy z mikroskopem, co wielokrotnie pozwala jej zaproponować skuteczne leczenie nawet w trudnych przypadkach. Zawsze potrafi dopasować najlepsze rozwiązania do indywidualnych potrzeb pacjenta, mając na uwadze jego dobro oraz komfort. Pacjenci cenią ją nie tylko za profesjonalizm, ale również za życzliwą i zawsze pomocną postawę.